- Antibiotics Tests in Milk

- Inhibitory detection test

- Laboratory equipment

- Centrifuges

- Indicator strips

- Autoclaves

- Scales

- Thermometers

- Packing

- PureTrust ATP monitoring

- ATP monitoring PIONEERPRODUKT CleanTrust

- MICROFAST® substrates

- Nutrient media

- Ice cream sticks

- Consumables

- Detergents and disinfectants

- Treatment agent

- Milk filters

- Wipes

- Gloves

- Sampling

US Broiler Market Outlook 51 Weeks Ending December 22, 2025

The pre-holiday rush is putting pressure on the market. Prices are adjusting, but sales volumes have risen sharply. This is a classic pattern before major holidays: retailers buy large quantities at current prices, causing a slight decline due to supply pressure, but the increase in volumes outweighs this.

Dark meat (shanks, drumsticks, and ground meat) is showing a 2-4% price correction —a healthy pause after a sharp rise. Meanwhile, sales volumes have surged by 16-18% due to active pre-holiday buying.

The premium segment (breast, fillet, and wing) is showing stabilization or minimal price growth (0.1-0.5%). Meanwhile, sales volume growth of 3-5% also confirms robust demand.

This week, prices may decline slightly due to profit-taking and the end of buying. Volumes will remain below the 51st week peak. The overall index may pause in the 115-117 range.

Price dynamics and sales volumes of broilers

Average weighted price of broilers by region

Region

Average price, cents/pound

Sales volume (thousands of pounds)

Week 50

Week 51

Weekly growth,%

Week 50

Week 51

Weekly growth,%

Oriental

112.95

114.75

1.6%

4,646

4,589

-1.2%

Central

98.08

99.54

1.5%

3,048

3,046

-0.1%

West

133.99

135.10

0.8%

3 141

3 205

2.0%

Average weighted price of broilers (carcass, chilled) in the USA

Chicken cutting price dynamics

Weekly reviews are available with a subscription.

Read together with it:

Express-tests PIONER 5 in1 for the determination of thiamphenicol, meloxicam, colistine, trimethoprim, sulfonamides

Express-tests PIONER 5 in1 for the determination of thiamphenicol, meloxicam, colistine, trimethoprim, sulfonamides Rapid tests PIONER 5 in 1 for the determination of sulfonamides, tylosin, tilmicosin, lincomycin, erythromycin, fluoroquinolones

Rapid tests PIONER 5 in 1 for the determination of sulfonamides, tylosin, tilmicosin, lincomycin, erythromycin, fluoroquinolones Express tests for determining the residual amount of β-lactams and tetracyclines in milk, whey

Express tests for determining the residual amount of β-lactams and tetracyclines in milk, whey Express tests for determining the residual amount of β-lactams, tetracyclines, chloramphenicol, streptomycins in milk, whey

Express tests for determining the residual amount of β-lactams, tetracyclines, chloramphenicol, streptomycins in milk, whey Rapid tests for determining the residual amount of tetracyclines in meat

Rapid tests for determining the residual amount of tetracyclines in meat Rapid 4 in 1 tests for determining the residual amount of neomycin, kanamycin, gentamicin, spectinomycin in milk, whey

Rapid 4 in 1 tests for determining the residual amount of neomycin, kanamycin, gentamicin, spectinomycin in milk, whey- Rapid tests for determining the residual amount of chloramphenicol in meat

- ANTIBIOTICS / ELISA TESTS

- Rapid tests for fluoroquinolone, erythromycin, lincomycin, tillosin and tilmycosin residues in milk, whey

- PIONEER MEIZHENG BIO-TECH (5 in1) JC0586 - Antibiotic tests 5 in 1 / Rapid tests for determining the residual amount of β-lactams, tetracyclines and cephalexin in milk, whey

Residual Acidity Test Strips, 100 pcs.

Residual Acidity Test Strips, 100 pcs. Testo 105 food thermometer

Testo 105 food thermometer Steam autoclaves/sterilizers GC (Russia)

Steam autoclaves/sterilizers GC (Russia) Milk thermometer TS-4M (Russia)

Milk thermometer TS-4M (Russia) Laboratory heating plate PL-01

Laboratory heating plate PL-01 Memmert IPP cooling incubators (Germany)

Memmert IPP cooling incubators (Germany)- Liston electric aquadistillers with built-in collector

- Analytical scales OHAUS PR 224, (220g/0.0001g)

- Milk quality analyzer "Laktan 1-4M" 500 isp. MINI

- Areometer AON - 1 (set of 19)

- Hydrometers for milk AM, AMT

- HM Series Rotary Homogenizers

- Butyrometers for milk, cream, skim milk and buttermilk

- Test strips "Urea in milk"

- Heating plate Tagler PN-4030MK

Paper for micro-ribbed

Paper for micro-ribbed Laminating paper KH PACK®

Laminating paper KH PACK® The paper packing fastened anticorrosive UNIK 14-70 THAT 5453-003-05773103-2005

The paper packing fastened anticorrosive UNIK 14-70 THAT 5453-003-05773103-2005 Ice cream chopsticks

Ice cream chopsticks Parchment

Parchment Korreks for desserts

Korreks for desserts- Korreks for confectionery

- GableTop aseptic packaging

- KH PACK® Straight Packing Paper

- Backed Foil

- Cartons for milk and dairy products

- Plastic packaging for cakes and pastries

- Salad dressings

- Paper sacks

- Grease and barrier paper KH PACK®

Ice cream sticks Magnum (curly)

Ice cream sticks Magnum (curly) Ice cream sticks (with logo)

Ice cream sticks (with logo) Auxiliaries for sugar products

Auxiliaries for sugar products Ice cream sticks Standard 93

Ice cream sticks Standard 93 J-Bottom technology

J-Bottom technology General purpose environment of SPC "Biocompass-S" (Uglich)

General purpose environment of SPC "Biocompass-S" (Uglich)- Ice cream sticks Standard 114

- Pepsin whey pork

- Ice cream sticks (round)

- Petri dish 90 mm

- Wafer cup and cone

Veterinary Needles Reusable

Veterinary Needles Reusable Stainless steel obstetric aid

Stainless steel obstetric aid Disinfectant with washing effect (10kg)

Disinfectant with washing effect (10kg) Apron and armlets

Apron and armlets Udder cleaner after milking (20 l)

Udder cleaner after milking (20 l) Cassettes for DCC somatic cell counter

Cassettes for DCC somatic cell counter- Dosing syringe, bottle attachment

- Plastic bracelet

- Milk bottle

- Reusable plastic syringe

- Fall with a loop for cattle

- Dosing syringe, hose attachment

- Liquid soap "Prestige" (yellow, green, red) 5 l

- Drencher for feeding calves with a rigid probe

- Pump for artificial ventilation of the lungs

MicroFast® Coliform & E.coli Count Plate

MicroFast® Coliform & E.coli Count Plate Yeast & Mold Count Plate (cat. no. LR1003) MicroFast® Yeast & Mold Count Plate

Yeast & Mold Count Plate (cat. no. LR1003) MicroFast® Yeast & Mold Count Plate MicroFast® Enterobacteriaceae Count Plate (cat. no. LR1011)

MicroFast® Enterobacteriaceae Count Plate (cat. no. LR1011) Substrate for determining QMAFAnM (catalog number LR1001)

Substrate for determining QMAFAnM (catalog number LR1001) MicroFast® Lactic Acid Bacteria Count Plate (Part Number LR1312)

MicroFast® Lactic Acid Bacteria Count Plate (Part Number LR1312) MicroFast® Bacillus cereus Count Plate (catalog number LR1010)

MicroFast® Bacillus cereus Count Plate (catalog number LR1010)- MicroFast® Salmonella Count Plate (SAL), for the determination of Salmonella in food and environmental samples (Catalog #LR1006)

- Coliform Count Plate (catalog number LR1002) MicroFast® Coliform Count Plate

- MicroFast® Microbiological Substrates

- MicroFast® Environmental Listeria Count Plate

- MicroFast® Staphyloccocus aureus Confirmation Plate Staph.aureus Confirmation Plate (cat. no. LR1005Q)

- Substrate for determining the number of staphylococci (Catalog number LR1005) MicroFast® Staphyloccocus aureus Count Plate

- Substrate for accelerated determination of QMAFAnM, (catalog number LR1321)

Выращивание зерновых и животноводство. Богданов обсудил перспективы сотрудничества в АПК Беларуси и Казахстана01.02.2026

Выращивание зерновых и животноводство. Богданов обсудил перспективы сотрудничества в АПК Беларуси и Казахстана01.02.2026 Выпойка молоком 3-4 раза, больше теплой воды. Как в Брестской области наладили уход за телятами в морозы01.02.2026

Выпойка молоком 3-4 раза, больше теплой воды. Как в Брестской области наладили уход за телятами в морозы01.02.2026 From Tractor Driver to Businessman: The Story of a Belarusian Who Built a Farm from Scratch and a Church in a Village 30.01.2026

From Tractor Driver to Businessman: The Story of a Belarusian Who Built a Farm from Scratch and a Church in a Village 30.01.2026- A warehouse in the Minsk region improperly stored powdered milk: a court ordered compensation of Br2 million.30.01.2026

- Increased processing volumes, new jobs: production capacity is being expanded in the Shklov district.30.01.2026

- История белоруса, построившего с нуля крепкое фермерское хозяйство и возродившего родную деревню29.01.2026

- Белорусские производители планируют выйти на катарский рынок мясной продукции29.01.2026

- Беларусь заинтересована в расширении поставок молочной продукции в Индонезию28.01.2026

- Рекорд по свекле, прирост по молоку: в Гродненской области подвели итоги работы АПК 28.01.2026

- Как идет зимовка на МТФ в Гродненской области и как переносят мороз озимые, рассказал специалист 28.01.2026

- Original products and two exhibition pavilions: Belarus's exhibit conquers the Gulfood exhibition in the UAE.27.01.2026

- Exchange trading on the BUCE: geography, sales leaders 27.01.2026

- Belarus intends to expand the range of goods in exchange trade with Azerbaijan.27.01.2026

- "The work of a scientist is at the heart of everything." Why BSUT focuses on science 25.01.2026

- Industrial development and new jobs: what projects are planned for the Klimovichsky District 24.01.2026

- A growth point and key development area: Krutoy on livestock farming in the Klimovichi district24.01.2026

В Магаданском порту проведён контроль за 195 тоннами животноводческой продукции30.01.2026

В Магаданском порту проведён контроль за 195 тоннами животноводческой продукции30.01.2026 Цены на говядину в России выросли на 1% за неделю, свинина подешевела на 0,4%30.01.2026

Цены на говядину в России выросли на 1% за неделю, свинина подешевела на 0,4%30.01.2026 Карантин по лейкозу КРС в Прилузском районе Коми отменён30.01.2026

Карантин по лейкозу КРС в Прилузском районе Коми отменён30.01.2026- На Ямале выявлены два заведения общепита, работающие без прослеживаемости мясной продукции30.01.2026

- Omsk Bacon increased production of semi-finished pork products by 17% in 2025.30.01.2026

- Птицефабрика «Агрокомплекс» увеличила производство товарного яйца на 9% в 2025 году30.01.2026

- Agrosila Holding presents a new product line at PRODEXPO-202630.01.2026

- Miratorg-Kursk receives environmental certification for the entire year 2026.30.01.2026

- Уругвай: мясные отрубы, субпродукты, генетика и ирригация — в повестке дня миссии в Китае30.01.2026

- Argentina: Record foreign exchange earnings from exports in 202530.01.2026

- Компания, создавшая гамбургеры Paty, обанкротилась: долг в 23 миллиарда долларов и 1000 недействительных чеков30.01.2026

- Парагвай готовится конкурировать на рынке экспорта живого скота в Турцию30.01.2026

- Геномная селекция в животноводстве Ставрополья: поддержка и новые перспективы29.01.2026

- Новый этап в агропромышленном развитии Тверской области: соглашение с Ферма СК29.01.2026

- Свинокомплекс "Сибагро" занимает лидирующие позиции на рынке Монголии29.01.2026

- Бывший чиновник из Нижегородской области лишился имущества за незаконное привлечение мигрантов29.01.2026

10 reasons to take a deposit04.05.2025

10 reasons to take a deposit04.05.2025 The EU confirmed discussions on banning entry for participants in the military operation.31.01.2026

The EU confirmed discussions on banning entry for participants in the military operation.31.01.2026 Bloomberg has revealed a new possible EU sanctions plan against Russia.31.01.2026

Bloomberg has revealed a new possible EU sanctions plan against Russia.31.01.2026- ЕС включил Россию в черный список по отмыванию денег30.01.2026

- The EU has imposed new sanctions on Iran in response to the suppression of protests.30.01.2026

- Евросоюз признал КСИР террористической организацией30.01.2026

- The US has eased sanctions and allowed oil companies to operate in Venezuela.30.01.2026

- Titov allowed for the return of foreign companies that "miss Moscow"30.01.2026

- Following the deal with Carlyle, LUKOIL continued negotiations with other companies.29.01.2026

- Макрон заявил о подготовке Францией новых санкций против России29.01.2026

- In Finland, Russian students were given suspended sentences for violating sanctions.28.01.2026

- Минэк сообщил о принудительном лицензировании технологий ушедших компаний28.01.2026

- Reuters reported on Airbus' letter to employees about damages and future crises.27.01.2026

- The EU Council approved fines for companies importing Russian gas.27.01.2026

- Лондон оштрафовал Банк Шотландии за нарушение санкций против России27.01.2026

- The Belgian Prime Minister stated that "Europe is not at war with Russia."22.01.2026

Antibiotics in milk: causes and methods of detection27.01.2026

Antibiotics in milk: causes and methods of detection27.01.2026 Pharmaceutical companies see a threat to EU security due to bacteria in Ukraine13.11.2025

Pharmaceutical companies see a threat to EU security due to bacteria in Ukraine13.11.2025 Прокуроры объявили предостережения более 5 тыс. компаний из-за роста цен09.09.2025

Прокуроры объявили предостережения более 5 тыс. компаний из-за роста цен09.09.2025- Две молочные компании из Азербайджана не захотели работать с Россией09.07.2025

- Лукашенко рассказал, как Путин угостил его козьим молоком08.07.2025

- Lukashenko demanded that Belarus be cleared of littered logs by autumn.08.07.2025

- Лукашенко заявил, что Белоруссии выгодно не «одуревши воевать», а кормить17.06.2025

- В Британии предупредили о риске для миллионов из-за супербактерий06.01.2025

- Moscow court sides with Indian company in dispute with Health Ministry26.11.2024

- Scientists estimate increase in mortality due to drug-resistant bacteria29.10.2024

- Antibiotics for livestock and pesticides found in poisoned family's home29.10.2024

- Izvestia reported on the shortage of widely used antibiotics in Russia29.10.2024

- The Ministry of Health called data on the shortage of antibiotics unreliable29.10.2024

- Scientists warn of threat of return to pre-penicillin times29.10.2024

- The Ministry of Health explained how attitudes towards antibiotics changed during the pandemic07.05.2024

- WHO explains the risks of taking antibiotics "just in case"06.05.2024

Antibiotics in pollock25.02.2024

Antibiotics in pollock25.02.2024 Antibiotics in herring: myth or reality?12.02.2024

Antibiotics in herring: myth or reality?12.02.2024 Antibiotics in perch10.02.2024

Antibiotics in perch10.02.2024- Antibiotics in sprat: facts and myths10.02.2024

- Antibiotics in tuna: an important health and environmental issue09.02.2024

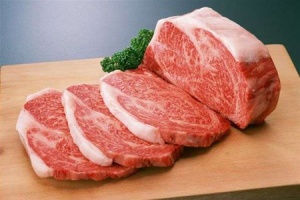

- Antibiotics in meat30.01.2024

- Antibiotics in chebureks: myth or reality?29.01.2024

- Antibiotics in cutlets: problem or myth?18.01.2024

- Antibiotics in Chicken: Where Are the Highest Concentrations?17.01.2024

- Antibiotics in carp17.01.2024

- Where Are More Antibiotics in Chicken: Reality and Cautions16.01.2024

- Antibiotics in Salmon: Safety and Product Quality16.01.2024

- Antibiotics in Turkey15.01.2024

- Antibiotics in Sal: Reality and Safety Issues15.01.2024

- Antibiotics in Fried Dumplings: Facts, Risks and How to Stay Safe15.01.2024

- Antibiotics in sausages14.01.2024

Antibiotics in Coffee: Myths and Reality03.05.2025

Antibiotics in Coffee: Myths and Reality03.05.2025 Forged forks: 10 interesting facts16.05.2024

Forged forks: 10 interesting facts16.05.2024 Swimming pool and weight loss: 10 interesting facts10.03.2024

Swimming pool and weight loss: 10 interesting facts10.03.2024- Tests for antibiotics in milk - 10 interesting facts07.03.2024

- Cleaning the kettle from scale, 10 interesting facts...06.03.2024

- Antibiotics in beer: 10 interesting facts04.03.2024

- Wild boar, how to survive...01.03.2024

- Purulent mastitis, 10 interesting facts27.02.2024

- Lemon and alcohol: 10 interesting facts25.02.2024

- Mint - 10 interesting facts25.02.2024

- Wild boar, 10 interesting facts20.02.2024

- Wild boar and domestic pig: comparison and advantages20.02.2024

- Cottage cheese, 10 interesting facts20.02.2024

- 10 Interesting Facts About Milk19.02.2024

- How to Clean a Toilet - 10 Interesting Facts (Acid vs Alkaline)18.02.2024

- Goat's milk: 10 interesting facts16.02.2024

Dicroceliosis in cattle09.03.2024

Dicroceliosis in cattle09.03.2024 Demodicosis in cattle01.03.2024

Demodicosis in cattle01.03.2024 Purulent mastitis of cattle27.02.2024

Purulent mastitis of cattle27.02.2024- Hypodermatosis in cattle20.02.2024

- Hemonchoz in cattle11.02.2024

- Bursitis in cattle30.01.2024

- Brucellosis in cattle29.01.2024

- Bronchopneumonia in calves27.01.2024

- Bronchitis in cattle26.01.2024

- Mortellaro disease in cattle24.01.2024

- White muscle disease in cattle23.01.2024

- Babesiosis in cattle22.01.2024

- Cattle acidosis20.01.2024

- Arthritis in cattle20.01.2024

- Anaplasmosis in cattle18.01.2024

Antibiotics for coughs: when they are needed and when they are not11.02.2024

Antibiotics for coughs: when they are needed and when they are not11.02.2024 The State Traffic Inspectorate reminded drivers of road safety rules during severe frosts.31.01.2026

The State Traffic Inspectorate reminded drivers of road safety rules during severe frosts.31.01.2026 A woman driving under the influence of alcohol with over 2 ppm was detained in Minsk.30.01.2026

A woman driving under the influence of alcohol with over 2 ppm was detained in Minsk.30.01.2026- Наведение порядка в АПК, пожарная безопасность. Какие задачи поставлены перед прокурорами Витебской области 30.01.2026

- A car crashed into a tree on Independence Avenue in Minsk, injuring two people.30.01.2026

- Топ экспортируемых товаров назвали в "Белгоспищепроме"29.01.2026

- Житель Кировского района жестоко убил свою собаку, возбуждено уголовное дело29.01.2026

- Двух нетрезвых водителей с детьми в салоне остановили сотрудники ГАИ в Витебской области28.01.2026

- В Лидском районе задержали пьяного угонщика авто, который въехал в сугроб28.01.2026

- "Видеть болевые точки на местах и реагировать". На что нацелил витебскую милицию глава МВД28.01.2026

- Борьба с коррупцией, профилактика пожарной безопасности. Генеральный прокурор поставил задачи на коллегии в Гомеле 28.01.2026

- В Витебской области более 300 пешеходов за выходные привлекли к ответственности за нарушения ПДД27.01.2026

- Более 40 бесправников остановили на дорогах Гомельской области за три дня 27.01.2026

- A drunk driver without a license was stopped at gunpoint in the Minsk region.27.01.2026

- "Увидела противоположную сторону жизни". Женщина-участковый о самом сложном в работе24.01.2026

- In the Smorgon district, a teenager was driving a group of drunks and was involved in an accident. How was his father punished?24.01.2026

Persons

Our Partners

Top 10

Our Test - Pioneer Tests

- Express tests for determining the residual amount of β-lactams, tetracyclines, chloramphenicol, streptomycins in milk, whey

- TEST KIT for determination of inhibitory agents PIONEERPRODUKT® DASH-TEST, WC0040

- PIONEER MEIZHENG BIO-TECH (5 in1) JC0586 - Antibiotic tests 5 in 1 / Rapid tests for determining the residual amount of β-lactams, tetracyclines and cephalexin in milk, whey

- PIONEER MEIZHENG BIO-TECH (5 in1) JC0871/ Rapid tests for the determination of the residual amount of β-lactams, tetracyclines, chloramphenicol, streptomycins, ceftiofur in milk, whey.

- PIONEER MEIZHENG BIO-TECH (5 in1) JC1165 / Rapid tests for the determination of the residual amount of halofuginone, flavomycin, novobiocin, flunixin, dexamethasone / prednisolone in milk, whey