Bloomberg learned about the discussion in the EU of a tax on profits from Russian assets

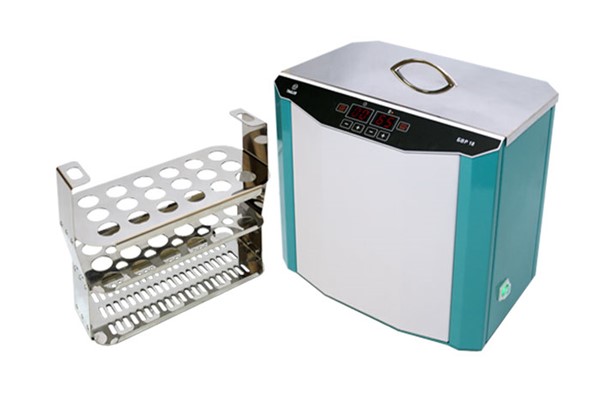

PIONEER MEIZHENG BIO-TECH (5 in1) JC0871/ Rapid tests for the determination of the residual amount of β-lactams, tetracyclines, chloramphenicol, streptomycins, ceftiofur in milk, whey.

PIONEER MEIZHENG BIO-TECH (5 in1) JC0871/ Rapid tests for the determination of the residual amount of β-lactams, tetracyclines, chloramphenicol, streptomycins, ceftiofur in milk, whey. Express-tests PIONER 5 in1 for the determination of thiamphenicol, meloxicam, colistine, trimethoprim, sulfonamides

Express-tests PIONER 5 in1 for the determination of thiamphenicol, meloxicam, colistine, trimethoprim, sulfonamides

This week, representatives of the European Commission (EC) will begin meeting with EU countries to discuss the introduction of a tax on windfall profits from the frozen assets of the Bank of Russia of €200 billion, Bloomberg reports, citing sources.

As the agency writes, the EC is going to propose a plan that will allow the legal transfer of income from blocked assets of the Central Bank to the budgets of EU countries . The plan involves three steps:

clarification of the scope of obligations for financial obligations; introduction of requirements for central securities depositories on the division of cash balances in Russian accounts; transfer of income to the EU budget.Bloomberg sources clarified that tomorrow, September 7, EC representatives will meet with officials from Spain, Belgium, Italy, France and Germany. Next week there will be a meeting with representatives of all 27 EU countries.

At the same time, as the agency notes, possible taxes and confiscation of excess profits raise both legal and financial questions for EU member countries. Some are concerned that if such a tax is introduced, investors may abandon the euro.

It is expected that the windfall from the assets of the Russian Central Bank frozen in the EU will amount to about €3 billion. More than half of the assets are cash and deposits, the rest are securities that will be converted into cash as they mature in the next two to three years. writes Bloomberg.

Read PionerProdukt .by What problems in the Chinese economy threaten the world with Growth of 21% or more: five Chinese stocks with an attractive upside Is it worth buying real estate in Kazakhstan: prices , profitability, pitfalls Not a single idea in my head. How to relearn creativityIn February 2022, after the start of the military operation in Ukraine , Western countries imposed sanctions against the Russian Central Bank and froze its foreign currency assets abroad. According to the head of the Ministry of Finance Anton Siluanov, Russia has lost access to half of its gold and foreign exchange reserves—about $300 billion. Bloomberg reported that $311 billion of Russian reserves were frozen and another €19 billion of sanctioned businessmen.

There have been repeated calls in the West and in Kyiv to use frozen Russian assets to restore Ukraine. In June, Bloomberg reported that the EU did not see a “credible legal path” that would allow them to be confiscated simply on the grounds that they are subject to sanctions. Instead, Brussels is considering two options for using the funds: transferring reinvestment proceeds to rebuild Ukraine, and a “contingency contribution” (which implies that companies that have made large profits from blocked Russian assets will have to transfer a significant amount to the EU).

The Russian authorities call the blocking of assets abroad illegal; the Kremlin said that they would consider their seizure in favor of Ukraine “in fact, outright theft.” President Vladimir Putin warned that such a policy “never brought anyone any good.”