Tinkoff Investments will suspend trading in the euro after EU sanctions

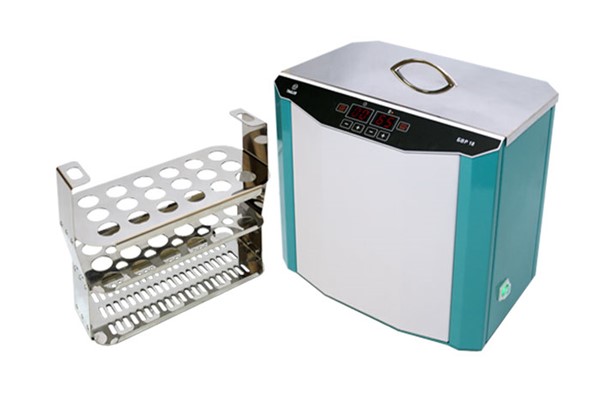

PIONEER MEIZHENG BIO-TECH (5 in1) JC0871/ Rapid tests for the determination of the residual amount of β-lactams, tetracyclines, chloramphenicol, streptomycins, ceftiofur in milk, whey.

PIONEER MEIZHENG BIO-TECH (5 in1) JC0871/ Rapid tests for the determination of the residual amount of β-lactams, tetracyclines, chloramphenicol, streptomycins, ceftiofur in milk, whey. Express tests for determining the residual amount of β-lactams, tetracyclines, chloramphenicol, streptomycins in milk, whey

Express tests for determining the residual amount of β-lactams, tetracyclines, chloramphenicol, streptomycins in milk, whey

Tinkoff Investments will suspend trading in euros from February 27, the broker said on his TELEGRAM channel.

“Euro withdrawals will be available. Euro trading will be suspended from 02/27/2023. Euros have been excluded from the list of liquid instruments," the statement said.

The broker also pointed out that the EU sanctions do not affect trading in other currencies, including the dollar, as well as their withdrawal by clients.

Tinkoff Investments will suspend trading in foreign securities Investments

The report says that Tinkoff Investments will withdraw the assets of clients to another, non-sanctioned company. “In order to avoid the risk of blocking, as well as to take all necessary actions for the transfer, we are temporarily suspending trading in foreign securities. Within 1-3 weeks, we plan to launch trading,” the broker said.

Tinkoff Bank for the first time came under Western sanctions. What is important to know Finance

Tinkoff Bank at the end of February came under EU sanctions. The introduction of restrictive measures in Brussels was explained by the fact that the bank is a backbone credit institution participating in sectors of the economy that “provide a significant source of income for the government” of RUSSIA. The tenth package of EU sanctions also included Alfa-Bank and Rosbank. Since last year, restrictive measures have been in place against the largest Russian banks, including Sberbank and VTB.

Read pioneerprodukt.by “He will fail you everything”: who and why is it dangerous to promote - six types Jump - you will earn more: why generations Y and Z choose job-hoppingwhy the norwegian sovereign wealth fund is losing moneyBlocking EU sanctions mean freezing assets in European jurisdiction and a ban on transactions with the euro. Structures from the European Union cannot do business with those on the sanctions list, which, among other things, leads to disconnection from the international financial messaging system (SWIFT, sub-sanctioned Sberbank, VTB, Promsvyazbank, Otkritie and others were disconnected last spring).

Russia has repeatedly called Western sanctions illegitimate and illegal because they were adopted without the approval of the UN Security Council.

Tinkoff Bank, after the imposition of EU sanctions, said that it had prepared for such a scenario and worked for several months to ensure that its services continued to function as usual, regardless of external circumstances.

According to data as of July 2022, the number of Tinkoff Investments clients exceeds 11 million people. Tinkoff Bank is the main asset of TCS Group, 35% of which is owned by Vladimir Potanin's Interros, about 60% of the shares are in free float, 6.5% are owned by management.

Read together with it:

- ФАО: мировые цены на продовольствие снижаются второй месяц подрядДжим Вайкофф Среднее значение Индекса цен на продовольствие ФАО в октябре составило 126,4 пункта, снизившись с пересмотренного значения в 128,5 пункта в сентябре, что представляет собой небольшое снижение в годовом исчислении и на 21,1% ниже пикового значения в марте 2022 года. Лидером снижения стал сахар: его субиндекс упал на 5,3% до самого низкого уровня с декабря 2......

- Analysts reported a drop in Russian oil shipments to India.In November, Russian oil shipments to India fell by 66% compared to the previous month due to "logistics tactics" that importers resorted to in anticipation of sanctions, ET reports. Moscow considers the measures illegal.Russian oil shipments to India fell 66% from November 1 to 17 compared to the same period the previous month, according to The Economic Times (ET), citing a report from analytics ...

- The Russian-Serbian NIS has requested permission from the US to operate under sanctions.NIS has requested permission from the US Treasury Department to conduct operations while negotiations on a change in ownership structure are ongoing. Washington is demanding Russia's withdrawal from NIS. Serbian authorities have warned that NIS will be unable to operate without this license.Serbia's state-owned oil company (Naftna Industrija Srbije, NIS) has requested permission from the United St...

- Telegraph написала о «потере связи с реальностью» ЗеленскимНа фоне политического и военного кризиса на Украине Зеленский заключает сделки по покупке оружия и газа, которые Киев не сможет себе позволить без финансирования ЕС, что остается под вопросом, пишет журналист The Telegraph Президент Украины Владимир Зеленский на фоне масштабного коррупционного скандала в стране, к которому причастны его сторонники, заключил несколько сделок о закупках в оборонном ...

- Bloomberg узнал, как санкции снизили закупки Китаем российской нефтиПо оценке Rystad Energy AS, китайский импорт российской нефти морем может сократиться на 500–800 тыс. баррелей в день, что составляет две трети обычного уровня Общий объем импорта российской нефти в Китай снизился на две трети из-за санкций США, сообщает BLOOMBERG. По его данным, крупные государственные нефтеперерабатывающие компании приостановили закупки нефти марки ESPO, которая составляет основ...

- Песков призвал дождаться деталей поддержанного Трампом проекта о санкцияхСудьба законопроекта пока неясна, отметили в Кремле. Ранее проект с санкциями против России поддержал президент США Дмитрий Песков Законопроект США о введении новых санкций за сотрудничество с Россией не отразится на работе Шанхайской организации сотрудничества (ШОС), но нужно дождаться подробностей американской инициативы. Об этом заявил журналистам пресс-секретарь президента Дмитрий Песков, пере...

- MGAP ужесточает контроль после обнаружения остатков эктопаразитицидов в говядинеМинистерство животноводства, сельского хозяйства и рыболовства ( MGAP ) через Главное управление животноводческих служб ( DGSG ) издало Постановление № 311/2025, которое устанавливает в качестве серьезного или очень серьезного правонарушения обнаружение остатков эктопаразитицидных ветеринарных препаратов у крупного рогатого скота , предназначенного на убой, в количествах, превышающих установленные...

- В Казахстане проекты с участием ЛУКОЙЛа исключили из санкций СШАТеперь деятельности проектов ничего не угрожает, заявили в Минэнерго Казахстана. Речь, в частности, идет о проекте освоения Карачаганакского месторождения Карачаганакское месторождение Крупные казахстанские проекты с участием российской компании ЛУКОЙЛ получили исключение из санкций США, их работе ничего не угрожает, заявил глава Минэнерго Казахстана Ерлан Аккенженов. Его слова приводит «Интерфакс...

- Премьер Ирака обсудил с Алекперовым санкции США против ЛУКОЙЛаАлекперов и ас-Судани обсудили варианты стабилизации ситуации с добычей нефти после того, как США ввели санкции против ЛУКОЙЛа. Российская компания является оператором крупнейшего месторождения нефти в Ираке — Западная Курна — 2 Мухаммед Шиа ас-Судани Премьер-министр Ирака Мухаммед Шиа аль-Судани встретился c основателем ЛУКОЙЛа Вагитом Алекперовым. Они обсудили поиск решений для стабилизации ситу...

- Rabobank: бразильский свиноводческий сектор будет лидером по росту производства животного белка к 2030 годуПо прогнозам Rabobank, производство куриного мяса в Бразилии к 2026 году увеличится на 2% по сравнению с 1,6% в США и до 2% в ЕС, что может повлиять на мировые цены. Несмотря на это, экспортные перспективы Бразилии остаются сильными. Консалтинговая компания Safras & Mercado прогнозирует, что Бразилия экспортирует 5,5 млн тонн куриного мяса в 2......