RBI asked for sanctions relief against Rasperia to unblock Strabag shares

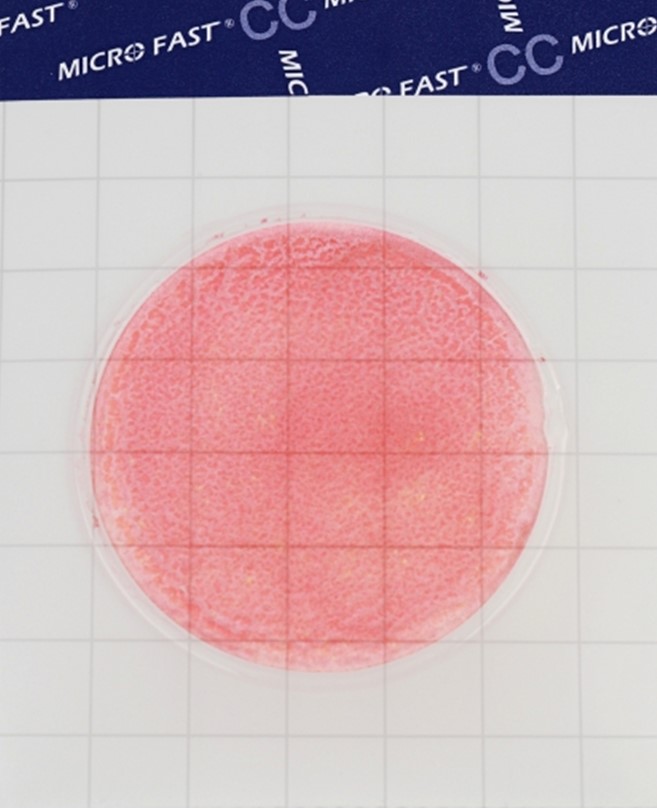

PIONEER MEIZHENG BIO-TECH (5 in1) JC0871/ Rapid tests for the determination of the residual amount of β-lactams, tetracyclines, chloramphenicol, streptomycins, ceftiofur in milk, whey.

PIONEER MEIZHENG BIO-TECH (5 in1) JC0871/ Rapid tests for the determination of the residual amount of β-lactams, tetracyclines, chloramphenicol, streptomycins, ceftiofur in milk, whey. Rapid tests PIONER 5 in 1 for the determination of sulfonamides, tylosin, tilmicosin, lincomycin, erythromycin, fluoroquinolones

Rapid tests PIONER 5 in 1 for the determination of sulfonamides, tylosin, tilmicosin, lincomycin, erythromycin, fluoroquinolones

Raiffeisen Bank International (RBI) has asked the European Union to lift sanctions against Rasperia Trading, reportsBLOOMBERG, citing RBI head Johan Strobl.

If the EU makes such a decision, Raiffeisen will be able to acquire a 24% stake in the construction company Strabag, which belongs to Rasperia. And the RBI, by a Russian court ruling, was ordered to pay the company $2.4 billion in damages. According to Strobl, this money is already in Russia.

Austria has made this request, but several EU countries are opposed, Bloomberg points out, as it would create a “precedent.”

Sources previously reported to the Financial Times (FT) that the matter was under consideration. According to them, the EU is concerned that lifting sanctions will strengthen the position of Russian courts, which are ordering the confiscation of Western assets in response to the restrictive measures.

Rasperia Trading was hit by EU sanctions last year and has also been subject to US restrictions .

At the end of 2023, Raiffeisen announced that it would acquire Rasperia's stake in Strabag through Russia's Raiffeisenbank, which would then transfer the shares to the parent group as dividends.

According to dataREUTERS : Rasperia was previously controlled by Oleg Deripaska. He sold the entire company, including his Strabag shares.

In January of this year, the Kaliningrad Regional Arbitration Court ordered Raiffeisenbank, a subsidiary of RBI, to pay €2 billion to MKAO Rasperia Trading Limited and, in exchange, accept an equivalent amount of Strabag shares onto its balance sheet. RBI appealed the decision, but in April, the Thirteenth Arbitration Court of Appeal upheld it. The Austrian bank promised to comply with the court's demands .

Raiffeisen is in talks to exit the Russian market, but has so far been unable to sell its assets in the country. Reuters reported on October 1 that RBI had made an unsuccessful attempt to sell its Russian subsidiary.

ReadPIONERPRODUKT .by inTELEGRAM .